Summary

DELTA AIR LINES REPORTS FIRST-QUARTER 2022 : NET LOSE OF $940 MILLION ($1.23 LOSE PER SHARE)

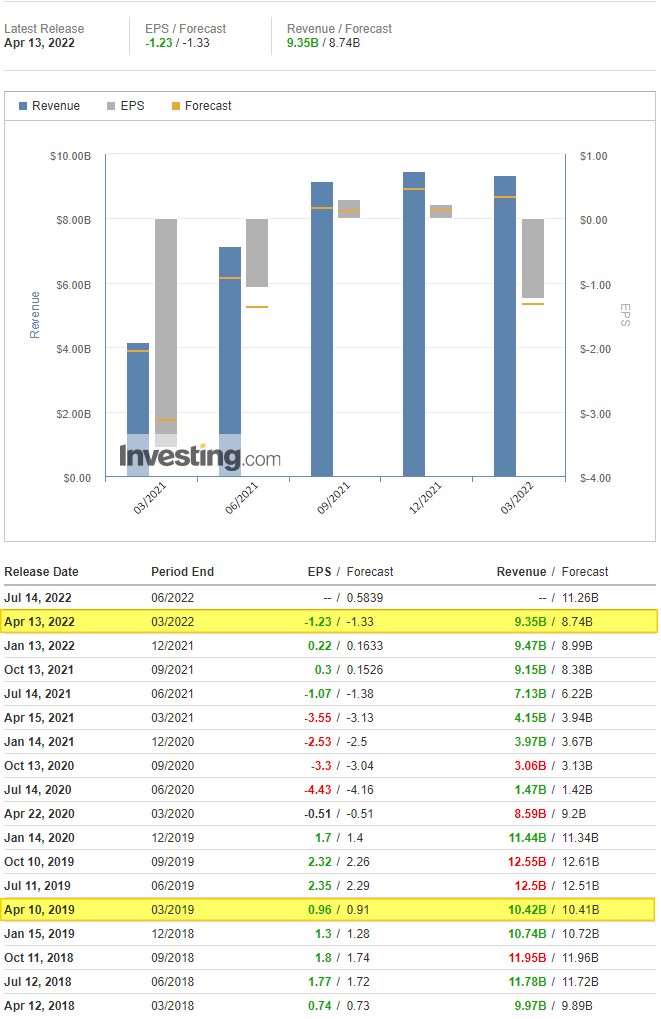

- Adjusted loss per share: $1.23 vs $1.27 expected.

- Revenue: $9.35 billion vs $8.92 billion expected.

- The carrier reported a net loss of $940 million for the first three months of the year on revenue of $9.35 billion, above the $8.92 billion in sales that analysts polled by Refinitiv expected. Sales were off 11% from 2019 levels.

FIRST-QUARTER 2022 RESULTS

• Adjusted operating loss of $793 million excludes a net gain of $9 million

• Pre-tax loss of $1.2 billion with adjusted pre-tax loss of $1.0 billion, excluding a net expense of $164 million

• Adjusted operating revenue of $8.2 billion, which excludes third-party refinery sales, was 79 percent recovered versus March quarter 2019 on capacity that was 83 percent restored

• Total operating expense of $10.1 billion increased $679 million compared to the March quarter 2019

• Adjusted for costs primarily from third-party refinery sales, total operating expense of $9.0 billion decreased $400 million or 4 percent in the March quarter 2022 versus the comparable 2019 period

• Generated $1.8 billion of operating cash flow and $197 million of free cash flow, after investing $1.6 billion into the business, primarily related to aircraft purchases and modifications

• At the end of the March quarter, the company had $12.8 billion in liquidity, including cash and cash equivalents, short-term investments and undrawn revolving credit facilities

Revenue Environment

“Delta is well-positioned to capitalize on robust consumer demand and an accelerating return of business and international travel. The strength of Delta's brand has never been more evident with record-setting performance for co-brand card acquisitions, co-brand spend and SkyMiles acquisitions in March,” said Glen Hauenstein, Delta’s president. "In the June quarter, we are successfully recapturing higher fuel prices and expect our revenue recovery to accelerate to 93 to 97 percent with unit revenue up double digits compared to 2019."

Adjusted operating revenue of $8.2 billion for the March quarter 2022 was 79 percent restored to March quarter 2019 levels, 5 points ahead of the mid-point of the company's initial guidance. Compared to the March quarter 2019, total passenger revenue was 75 percent recovered on system capacity that was 83 percent restored. Domestic passenger revenue was 83 percent recovered, and international passenger revenue was 54 percent restored in the March quarter.

Consumer demand accelerated through the quarter, highlighted by strong spring break performance. As omicron faded, offices reopened and travel restrictions were lifted, resulting in an improvement in business travel demand and a stronger fare environment.

Revenue-related Highlights:

• Unit revenue exceeds 2019 levels in March month for the first time in two years: March quarter adjusted total unit revenue (TRASM) was 5 percent lower than the same period in 2019. As demand improved, March month adjusted TRASM inflected to positive versus 2019, marking the first month of positive unit revenue versus 2019 since the start of the pandemic. This strength was led by premium revenue and diversified revenue streams, including loyalty and cargo.

• Business travel recovery boosted by improvement in corporate: Domestic corporate sales* for the quarter were ~50 percent recovered, with March improving to ~70 percent versus 2019. International corporate sales for the quarter were ~35 percent recovered, with March improving to ~50 percent versus 2019. Internationally, Transatlantic improved the most as European countries reopened.

• Premium cabin revenue recovery outpacing Main Cabin: Premium products continued to lead the recovery with Domestic premium revenue approximately 100 percent restored to 2019 levels in the month of March. Domestic and Latin premium product revenue recovery outpaced Main Cabin by approximately 10 points during the March quarter. *Corporate sales include tickets sold to corporate contracted customers, including tickets for travel during and beyond the referenced time period 2

• American Express remuneration 25 percent higher than 2019 levels: American Express remuneration of $1.2 billion in the quarter was up 25 percent compared to March quarter 2019. Co-brand spend was up 35 percent compared to March quarter 2019, reflecting a significant increase in T&E spend, with air travel spend outpacing lodging in the month of March for the first time since 2019. Co-brand acquisitions were nearly 95 percent recovered compared to March quarter 2019.

• Cargo strength continues with record revenue month in March: Cargo revenue was $289 million for the March quarter, a 51 percent increase compared to the same period in 2019 on strong demand and yields.

Comments

"With a strong rebound in demand as omicron faded, we returned to profitability in the month of March, producing a solid adjusted operating margin of almost 10 percent. As our brand preference and demand momentum grow, we are successfully recapturing higher fuel prices, driving our outlook for a 12 to 14 percent adjusted operating margin and strong free cash flow in the June quarter,” said Ed Bastian, Delta’s chief executive officer. “I would like to thank the Delta people, who once again enabled our best-in-class operational performance, provided an unmatched customer experience and continue to power our industry leadership each and every day.”

<관련 기사>

Delta News Hub - Delta Air Lines announces March quarter 2022 financial results

<Delta Air Lines Result Report : 2022 Q1- Source Link>

미국주식 | 2022년 4월 주요 이벤트 및 이슈 : 221Q어닝시즌, FOMC의사록공개와 미국채 10년물 금리,

2022년 4월 주요 이벤트 4월 6일(수) : FOMC의사록 공개 4월 12일(화) : 미국 CPI 지수(인플레이션지수) 발표. 4월 13일(수) : 금융사인 JP모건, 웰스파고, 델타에어라인 미국 22년 1Q 어닝시즌 시작

9valuemining.tistory.com

<특징주 히스토리>

미국특징주 | 2022-04-12 시장에서 가장 큰 움직임을 보인 미국 주식 : Wolfspeed, Trip.com, Cloudflare, Marathon Oil

미국특징주 | 2022-04-12 신고가 기록한 33개 미국 주식 : Coca-Cola,Shell,Altria , Petroleo Brasileiro

미국특징주 | 2022-04-05 신고가 기록한 미국 주식 60 : UnitedHealth, Walmart, AbbVie, Eli Lilly, Coca-Cola

미국특징주 | 2022-04-05 시장에서 가장 큰 움직임을 보인 종목

<우량주 관련>

미국우량주 | 미국 섹터별 대장주 주가 수익률 (ver.2022.04.01)

[시가총액] 미국 우량주 리스트 | 2021.08.3 기준 시가총액 순위 TOP 200

<투자전략 및 아이디어>

<배당 관련 이전 포스팅>

[배당] 2020년 8월 귀족 배당 기업 | WalMart, Microsoft, LockheedMartin, EliLilly, Intel, Starbucks

[배당]미국 최고의 월배당 주식들(O, STAG, MAIN)

[배당]미국 우량주 배당률 현황 | 시가총액 상위 100위 기업들