Summary

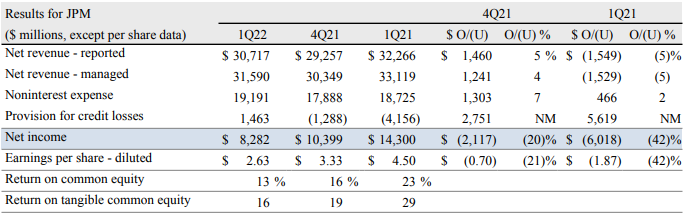

JPMORGAN CHASE REPORTS FIRST-QUARTER 2022 : NET INCOME OF $8.3 BILLION ($2.63 PER SHARE)

- earnings(EPS) : $2.76 a share vs $2.69 estimate.

- Revenue: $31.59 billion vs. $30.86 billion estimate,

- 이윤은 1년 전보다 42% 감소한 82억8000만 달러(주당 2.63달러)를 기록.

- 러시아와 관련된 13센트의 영향을 제외한 조정 수입 $2.76은 Refinitiv가 조사한 애널리스트들의 추정치 $2.69를 초과

FIRST-QUARTER 2022 RESULTS

Firmwide Metrics

- Reported revenue of $30.7 billion; managed revenue of $31.6 billion2

- Credit costs of $1.5 billion included a $902 million net reserve build and $582 million of net charge-offs

- Average loans up 5%; average deposits up 13%

- $1.7 trillion of liquidity sources, including HQLA and unencumbered marketable securities6

CCB ROE 23%

- Average deposits up 18%; client investment assets up 9%

- Average loans down 1% YoY and down 2% QoQ; Card net charge-off rate of 1.37%

- Debit and credit card sales volume7 up 21% n Active mobile customers8 up 11%

CIB ROE 17%

- #1 ranking for Global Investment Banking fees with 8.0% wallet share in 1Q22

- Total Markets revenue of $8.8 billion, down 3%, with Fixed Income Markets down 1% and Equity Markets down 7%

CB ROE 13%

- Gross Investment Banking revenue of $729 million, down 35%

- Average loans up 2% YoY and up 2% QoQ; average deposits up 9%

AWM ROE 23%

- n Assets under management (AUM) of $3.0 trillion, up 4%

- n Average loans up 14% YoY and 3% QoQ; average deposits up 39%

SIGNIFICANT ITEMS

- 1Q22 results included: n $902 million net credit reserve build Firmwide ($0.23 decrease in earnings per share (EPS))

- $524 million of losses within Credit Adjustments & Other in CIB driven by funding spread widening as well as credit valuation adjustments relating to both increases in commodities exposures and markdowns of derivatives receivables from Russia-associated counterparties ($0.13 decrease in EPS)

CAPITAL DISTRIBUTED

- Common dividend of $3.0 billion, or $1.00 per share

- $1.7 billion of common stock net repurchases in 1Q225

- The Firm’s Board of Directors has authorized a new common equity share repurchase program of $30 billion, effective May 1, 20225

FORTRESS PRINCIPLES

- Book value per share of $86.16, up 5%; tangible book value per share2 of $69.58, up 5%

- Basel III common equity Tier 1 capital3 of $208 billion and Standardized ratio3 of 11.9%; Advanced ratio3 of 12.6%

- Firm supplementary leverage ratio of 5.2%

OPERATING LEVERAGE

- 1Q22 expense of $19.2 billion; reported overhead ratio of 62%; managed overhead ratio2 of 61%

SUPPORTED CONSUMERS, BUSINESSES & COMMUNITIES

- $640 billion of credit and capital9 raised in 1Q22 n $69 billion of credit for consumers

- $8 billion of credit for U.S. small businesses n $265 billion of credit for corporations

- $282 billion of capital raised for corporate clients and non-U.S. government entities

- $16 billion of credit and capital raised for nonprofit and U.S. government entities, including states, municipalities, hospitals and universities

Comments

Jamie Dimon, Chairman and CEO, commented on the financial results: “JPMorgan Chase generated a healthy $30 billion of revenue, $8.3 billion of earnings and an ROTCE of 16% in the first quarter after adding $902 million in credit reserves largely due to higher probabilities of downside risks. Lending strength continued with average firmwide loans up 5% while credit losses are still at historically low levels. We remain optimistic on the economy, at least for the short term – consumer and business balance sheets as well as consumer spending remain at healthy levels – but see significant geopolitical and economic challenges ahead due to high inflation, supply chain issues and the war in Ukraine.”

Dimon continued: “In Consumer & Community Banking, deposits were up 18% and client investment assets were up 9%, largely driven by positive net flows. Combined debit and credit card spend was up 21% as we continue to see a pick-up in credit card spending on travel and dining. Card loan balances were up 11% but remain below prepandemic levels. Auto loans were up 3% but the lack of vehicle supply continues to affect originations which were down 25%. In Home Lending, originations of $25 billion were down 37%, primarily due to the rising rate environment. In the Corporate & Investment Bank, we maintained our #1 ranking in Global Investment Banking although fees were down 31% due to lower equity and debt underwriting activity. Markets revenue was down 3% compared to a record first quarter last year. Commercial Banking loans were up 2% and we are seeing a pick-up in both new loan demand as well as revolver utilization. Asset & Wealth Management delivered strong results as we saw positive inflows into long-term products of $19 billion across all channels, as well as continued strong loan growth, up 14%, primarily driven by securities-based lending.”

Dimon added: “Our financial discipline, constant investment in innovation and ongoing development of our people are what enabled us to persevere in our steadfast dedication to help clients, communities and countries throughout the world even in difficult times. In the quarter, we extended credit and raised capital of $640 billion for large and small businesses, governments and U.S. consumers. Our longstanding capital hierarchy remains the same - first and foremost, to invest in and grow our market-leading businesses; second, to pay a sustainable competitive dividend; and then, to return any remaining excess capital to shareholders through stock buybacks.”

Dimon concluded: “Our focus this quarter remained on helping our clients navigate difficult markets and unpredictable events, which included working with governments to implement economic sanctions of unprecedented complexity. While our company will continue to deal with this global turmoil, our hearts go out to the extreme suffering of the Ukrainian people and to all of those affected by the war.”

<관련 기사>

CNBC - JPMorgan Chase reports $524 million hit from market dislocations caused by Russia sanctions

JPMorganChase.com - Read the 2021 JPMorgan Chase & Co. Annual Report

<JP Morgan Result Report : 2022 Q1- Source Link>

미국주식 | 2022년 4월 주요 이벤트 및 이슈 : 221Q어닝시즌, FOMC의사록공개와 미국채 10년물 금리,

2022년 4월 주요 이벤트 4월 6일(수) : FOMC의사록 공개 4월 12일(화) : 미국 CPI 지수(인플레이션지수) 발표. 4월 13일(수) : 금융사인 JP모건, 웰스파고, 델타에어라인 미국 22년 1Q 어닝시즌 시작

9valuemining.tistory.com

<특징주 히스토리>

미국특징주 | 2022-04-12 시장에서 가장 큰 움직임을 보인 미국 주식 : Wolfspeed, Trip.com, Cloudflare, Marathon Oil

미국특징주 | 2022-04-12 신고가 기록한 33개 미국 주식 : Coca-Cola,Shell,Altria , Petroleo Brasileiro

미국특징주 | 2022-04-05 신고가 기록한 미국 주식 60 : UnitedHealth, Walmart, AbbVie, Eli Lilly, Coca-Cola

미국특징주 | 2022-04-05 시장에서 가장 큰 움직임을 보인 종목

<우량주 관련>

미국우량주 | 미국 섹터별 대장주 주가 수익률 (ver.2022.04.01)

[시가총액] 미국 우량주 리스트 | 2021.08.3 기준 시가총액 순위 TOP 200

<투자전략 및 아이디어>

<배당 관련 이전 포스팅>

[배당] 2020년 8월 귀족 배당 기업 | WalMart, Microsoft, LockheedMartin, EliLilly, Intel, Starbucks

[배당]미국 최고의 월배당 주식들(O, STAG, MAIN)

[배당]미국 우량주 배당률 현황 | 시가총액 상위 100위 기업들